Tuesday, September 18, 2018

The best tool for servicing your retirement plan participants

With the downward pressure on fees, coupled with fund menus increasingly using only passive funds, we are seeing 401(k) services becoming commoditized. In order to differentiate from the commodity crowd, advisors are returning to active participant support, and the better outcomes it provides, as a way of winning 401(k) business. Additionally, they are rolling out financial wellness as a way to further help their participants achieve their financial goals as well as way to recapture some of the revenue that has been lost as fees have been squeezed.

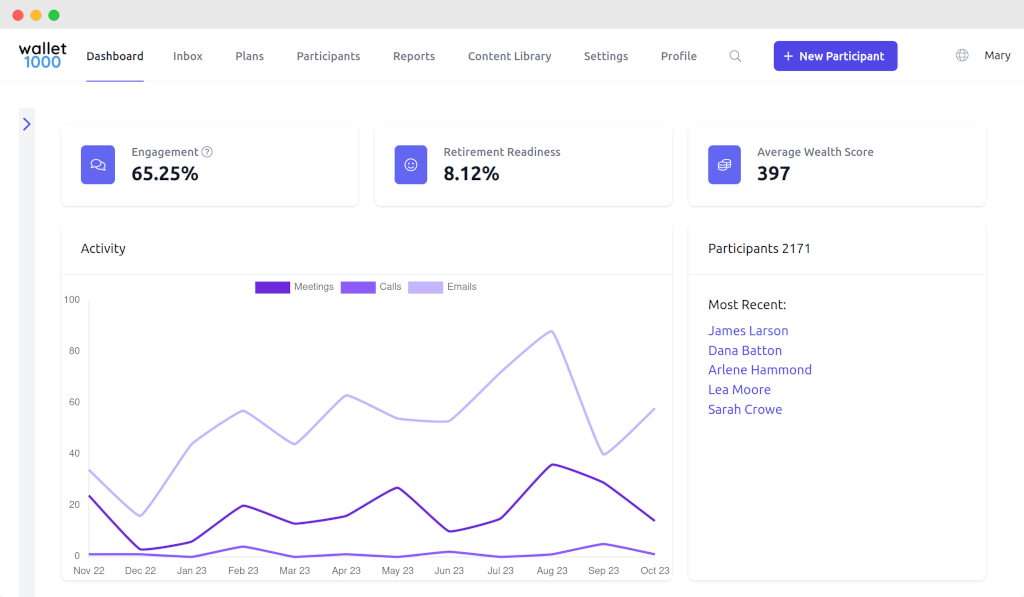

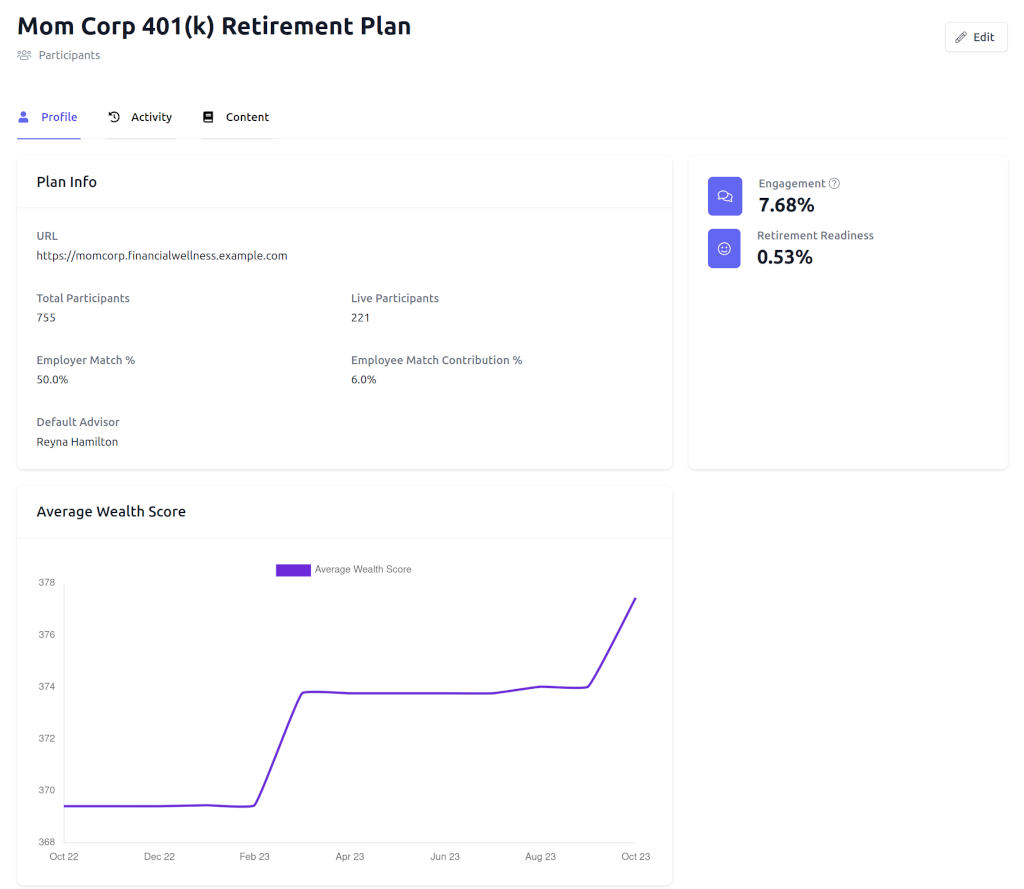

With those trends in mind we have created our Participant Engagement Platform (PEP) which is the robust advisor back-end for our financial wellness platform. With the PEP advisors can easily view a participant’s profile, track participant interactions, access a suite of reports and metrics that can be used in plan reviews and proposals, and use powerful automation capabilities that will help you scale your participant support as your 401(k) business grows.

Some features of the Wallet1000 Participant Engagement Platform:

The PEP becomes the home base for your participant support. With each call or meeting you can reference the participant’s profile, see where they stand on their financial wellness journey, assign them tasks (which they receive automated email reminders about), take notes on the call/meeting, and utilize the email templates for easy follow-up.

When preparing for plan reviews you can use report on engagement rate, retirement readiness rate, number of calls or meetings, most popular meeting topics, and financial wellness task completion. You can even segment a plan’s participants on each of those metrics in order to easily reach out to encourage them to take action (and to boost the metrics).

All metrics can be run on a plan-by-plan basis or across your whole book of business. With the latter you will be able to include metrics in your proposals that highlight improvements that your participants make with their financial wellness. Often it is your story that gets you in the door and the numbers that help seal the deal!

While participant support takes a commitment of resources and time, we truly believe that it is a solid foundation on which to build your 401(k) practice and one which helps you stand out in a crowded industry. With the Wallet1000 Participant Engagement Platform you can confidently offer an industry-leading level of service and know that it will scale along with your business.

Take your participant education to a new level with this free course about guiding participants to positive outcomes.